If you’re considering a divorce but you’re in a domestic violence situation, the first thing

to do is to stay safe and get out. Don’t worry about other things. It’s not worth risking your life to save some property! But if you could safely do something, these are the 10 things you should do before you file a divorce in Texas. If you would like this in a downloadable checklist form, contact me at www.LDHeard.com and give me your email address and name. I’ll send you one free.

- If you’re not the person who primarily pays the bills, look for all the necessary bills and find out how they get paid each month, and get copies of the most recent statements for all the regular monthly bills.

- Keep all copies of at least the last six months of monthly statements for every financial account, in either your name or your spouse’s name, all your investments, and all of your retirement accounts.

- If you’re going to request child support, get a copy of the spouse’s last three months of pay stubs. Also, your last two years of income tax returns with the W-2.

- If you have photos on your cell phone that you can use in court as evidence, then you need to get those photos downloaded someplace safe, where they won’t get lost or deleted. You should make printed copies of the photos. You can download those photos at Walgreens or go online to create those photos in an 8 x 10 size. That way they can be marked as evidence and handed to the judge.

- Compile all of those documents in a safe place in an envelope or folder. You might get a safe deposit box or ask a friend or relatives to keep your documents safe so that your spouse cannot hide them or destroy them once you file for a divorce.

- If you can safely talk to your spouse or if he/she is cooperative, go and have your bank account separated: one in your sole name, one in your spouse’s sole name, and preferably at different banks from where your joint bank account is.

Then you need to decide how you and your spouse contribute to those monthly bills because you may want your paycheck direct deposited into your sole bank account. But you’ll need to transfer some money back into the joint account every month to make sure that the bills are covered. Talk about that with your spouse and make sure that you emphasize that this is temporary. It could change once you get to the final divorce. It is true that all the money in a joint account belongs to both of you regardless of who earned it, but it will not look good if you take all of the money out and there is not enough left in the account to pay the bills.

- If you do not have a credit card in your own name, open a new credit card solely in your name and keep that account in your name only.

- Create a budget for all of your monthly expenses. Make it as if you are living on your own without your spouse’s income. This will help to prove what you need to make up the shortfall.

- Create a list of the major assets that you own with their value or worth. Be as specific as possible, including last 3 digits of account numbers and the VIN on your automobiles.

- Make an appointment and talk to an attorney. Find out how your debts and assets should be divided in a fair division before you could make anything into an agreement and, most importantly, don’t sign any written agreement until you talk to an attorney.

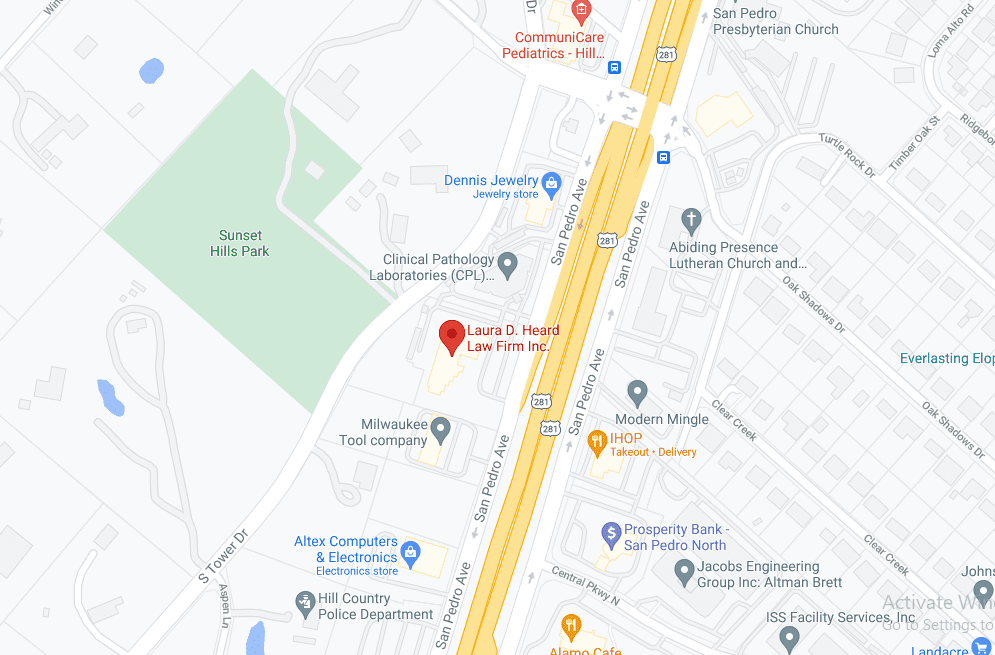

If you have questions, give me a call. I’m at 210-775-0353. You can also chat online at my website, www.LDHeard.com