As you plan for the things you want to do while you’re still alive, it is also wise to prepare for when you’re gone. You don’t want everything you’ve worked so hard for to end up in the wrong hands. You also want to protect your loved ones from a complex probate process in distributing your assets. Estate planning documents and Wills come in handy to help you accomplish this goal.

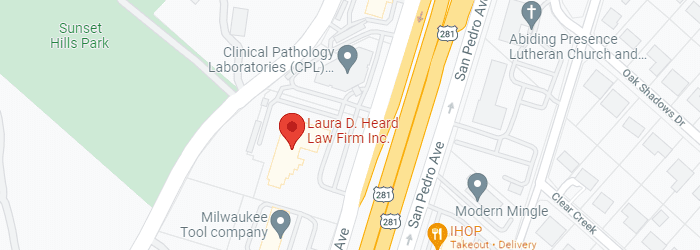

However, while the two go hand in hand, they are different. It would help to work with a renowned family law and estate planning law firm in San Antonio to ensure you get each right. The lawyers can provide legal counsel to help you make the right choice and capture everything correctly. They may suggest things that you never even thought about which may save you and your family time and money.

What is Estate Planning?

An estate plan is a comprehensive plan of action for your assets and can apply during your life and after your demise. It incorporates various tools, including wills, advance directives, powers of attorney, trusts, and more.

An estate plan can involve different types of power of attorney, like a healthcare power of attorney for medical decisions if you become incapacitated and a durable power of attorney for your finances. These documents can help in case you are unable to communicate due to an accident or medical condition, whether it is temporary or more permanent in nature. They can help your family take care of you and, at the same time, avoid the much more expensive procedure known as guardianship.

Despite the many tools included in an estate plan, it can be as broad or narrow as you deem fit. You may wish to create complex estate planning tools if you have a complicated estate. You may want to donate to charities to offset taxes that eventually go to heirs. However, if you feel that a will is enough to instruct how to distribute your estate and fulfill your wishes, use it instead. An attorney can advise you on whether a Will can accomplish your goals perhaps less expensively than a trust, or whether there is a good reason that you should make a trust as well. Beware of anyone who offers the same solution to everyone without knowing the individual situations. Different types of estates require different approaches.

What are the Key Documents for an Estate Plan?

Now that you know that an estate plan comprises many legal documents, you want to know which ones they are. Here are the most common ones:

Last Will and Testament

Texas family law and estate planning lawyers will tell you that a last will and testament form the foundation of any good estate plan. The document explains your wealth and estate distribution wishes and who will care for your children. The people or institutions receiving your assets according to the Will are your beneficiaries. Even if your goal is to avoid probate, you should have a Will just in case there is some asset that was left out of the trust. Otherwise, that property may be lost after your death due to the expense of recovering it without a Will.

Advance Directives: Living Will, Out-of-Hospital DNR, and Healthcare Power of Attorney

A “Living Will” which is officially called a “Directive to Physicians” stipulates your wishes for life-sustaining treatment (or to stop treatment) in cases where you suffer a condition that is terminal and offers little quality of life. You may want to carefully consider different possible scenarios as far as the type of treatments you would want or not want in case you could not communicate at that time. Would you want a feeding tube, IV fluids, or a respirator? Rather than appointing an agent to decide later, this document makes those decisions in advance and is placed in your medical record. This is just one example of a type of Advance Directive.

A healthcare power of attorney is the legal authority you give another person to make crucial decisions regarding your medical care. In most cases, the named individual also assumes durable medical power of attorney so that they can continue making the decisions if you become incapacitated. Often the Medical Power of Attorney is written such that it does not take effect unless two doctors certify that you are unable to make your own decisions. The Medical Power of Attorney is much more broad in scope than a Directive to Physicians, but it also encompasses the right to make that life or death decision regarding artificial life support. However, a Medical Power of Attorney could also authorize an agent to make decisions such as whether to put you in a nursing facility or whether to change your doctors or medications. There are a few limitations of things an agent cannot decide for you, such as to consent to a voluntary mental health commitment or an abortion.

Related to a Directive to Physicians, but different, is a document called a “DNR” or Do Not Resuscitate Order. The Out-of-Hospital DNR instructs all emergency personnel, such as firefighters and EMTs, not to do anything to resuscitate you such as CPR or use of a defibrillator in cases such as heart attack or choking. Such extreme instructions are commonplace in cases where hospice has been implemented.

All of the documents discussed in this section are collectively known as “Advance Directives.”

Appointment of Agent to Control Disposition of Remains

Many people today feel strongly that they wish to be cremated rather than buried. Other people may have specific desires about where they are to be buried. These desires can sometimes be the source of dispute among the surviving family. One person may say that their loved one wanted to be cremated, while other family members may be adamantly opposed to that idea. Family members may disagree about the burial in one location versus another location. Medical Powers of Attorney do not grant this power because they are void immediately upon the death of the maker.

Likewise, Wills are often not found or probated until weeks after the burial, and the executor does not automatically have the sole authority to make that decision unless it is specified in the Will. Crematoriums often will not perform the cremation without written consent of all or at least a majority of the family members. Thus, it is important in any estate plan to consider what should happen to the body of the deceased, or at least designate one person to make that decision and have the final say.

Beneficiary, POD, and TOD Designation Forms

You’ll use the beneficiary forms provided by the company or financial institution to dictate who receives your 401(k) assets, life insurance policies, and IRAs upon death. A payable on death (POD) form determines who will be the recipient of your checking or savings account proceeds. A transfer on death (TOD) form indicates who will receive the holdings in your brokerage accounts. You may also want to consider a Transfer on Death Deed to pass your real estate to someone automatically upon your death. Rights of Survivorship can even be attached to your motor vehicles.

If you use these estate planning documents correctly, you can help your beneficiaries avoid probate, at least as far as those particular assets are concerned. Consider talking to a knowledgeable San Antonio wills attorney to ensure you do everything right. A skilled lawyer can advise you on what documents to prepare, evaluate the records and seal any loopholes that may later cause problems.

What is a Will?

A Will is a legal document that instructs your beneficiaries on how you want them to distribute your assets when you pass on. You can also use it to lay out your wishes about how your children will be cared for upon your demise by naming a guardian and/or trustee. A Will allows you to name an executor who will be in charge of carrying out the actions you outline in your Will.

It’s in your best interest to work with a skilled and experienced San Antonio wills attorney to create a will. Without a Will, your estate will be subject to the rigid rules of Texas lawmakers. Even a tiny mistake can lead to significant problems, and an experienced lawyer can help you prevent that from happening. The difference between transferring assets to the surviving family of a deceased person who had planned ahead with estate planning documents and someone who did not plan ahead, may mean the difference in thousands of dollars of fees and years of frozen assets.

Do I Need to Name Anyone Other Than an Executor in My Will?

You can name more than one executor when making an estate planning document. The named executors may be designated to serve jointly or consecutively. Naming an alternate executor in your Will means you’ll still have a say as to who will execute your wishes if your first appointed representative cannot fulfill the role.

Things change over time that you have no control over, impacting the role of the person you choose to act as your executor. For example, the executor may:

- Die before, at the same time as you, or immediately after your death

- Need to relocate for family or work purposes outside the geographic area and not be able to execute your wishes

- Become mentally incapable of performing the role of an executor

- Succumb to an addiction that was not evident at the time you chose them

- Marry or take on responsibilities that make it difficult for them to play the role

- Develop an illness that compromises their capability as an executor

- File for personal bankruptcy or be convicted of a felony which would legally disqualify them to serve as executor

These factors may impact how your estate is distributed after your death. They point to the importance of having an alternate executor who can take up the role if such eventualities arise.

What Are Living Trusts and Testamentary Trusts?

A trust is another document that allows an agent to manage property for the benefit of someone else. The trust implemented and effective during a person’s lifetime is known as a “living trust.” A trust that does not take effect until death may be included in a Will and is known as a “testamentary trust.” Both Living Trusts and Testamentary

Trusts have long been used to avoid Estate Taxes for large estates. Living trusts are also often promoted as a way to avoid Probate. An experienced estate planning attorney can advise you on whether a trust would be beneficial to your situation, or whether the hassle and cost of creating and maintaining a trust may be more than the cost of an uncontested probate of a Will. This analysis varies greatly depending upon the State in which you live and the type of property you own. A trust may be useful for avoiding a Will contest, for avoiding certain taxes, and may be helpful if a person owns real estate in multiple states or countries. The owners of certain types of firearms may also need a firearms trust to legally pass the ownership of their firearms.

What is the Difference Between Estate Planning and Will Planning?

An estate plan is a collection of documents comprising several other tools, including a Will. It’s a collection of legal documents that can handle various issues that a Will can’t cover. It ensures you take care of your heirs even in your demise.

On the other hand, a Will is a single legal document that provides an excellent place to start estate planning. Everyone needs a Will just in case the alternative documents fail to cover everything. The Will may be a catch-all that simply states if you forgot any property, that property should be transferred into your trust after your death. The difference between transferring assets with a Will versus with no estate planning document, is a huge difference in time and expense. Additionally, if you have minor children, you may want to use the Will to designate a guardian for the children, even if you have a trust to transfer your property.

However, depending on the circumstances, it could lead your heirs into trouble if your estate goes into probate, making the process strenuous and expensive for those involved. Besides, a Will may subject your property to hefty taxes depending on the size of your estate and location of your property.

Some people think that Wills are for the average person while estate plans are for the wealthy, but this couldn’t be further from the truth. Many a poor farmer or rancher has lost their land because the value of their land exceeded estate tax thresholds even though they had very little in the way of any other assets. Regardless of your estate size, covering all bases would help. Consult with a San Antonio wills lawyer for informed guidance.

Protect Your Future with Professional Help

Estate planning is a complex process as there are many documents involved. You also must keep track of them and update them regularly as necessary. Making an estate plan is not a once-in-a-lifetime effort because there are many things that could affect the plan over time. The laws may change, your financial situation may change, your family situation may change, deaths or divorce or simply the age of your children may change your plan. Therefore, working with a skilled and experienced Wills attorney in Texas is advisable.

Our law firm has a team of legal experts to help you draft your estate planning documents. We can oversee the process to ensure you clearly state your wishes and that they comply with the law to prevent future problems. Laura D. Heard has been helping people with their estate planning since 1987. People often are surprised that what they thought would be such a complicated process is made easier after speaking with the attorney. We can also help you name an executor and identify beneficiaries. Get in touch with us to get started.