How Can Executors Make the Texas Probate Process Easier?

Being appointed an estate executor can be an exciting yet challenging responsibility. Your primary role is to ensure the decedent’s final wishes of distributing their estate are fulfilled, and the beneficiaries get what is rightfully theirs.

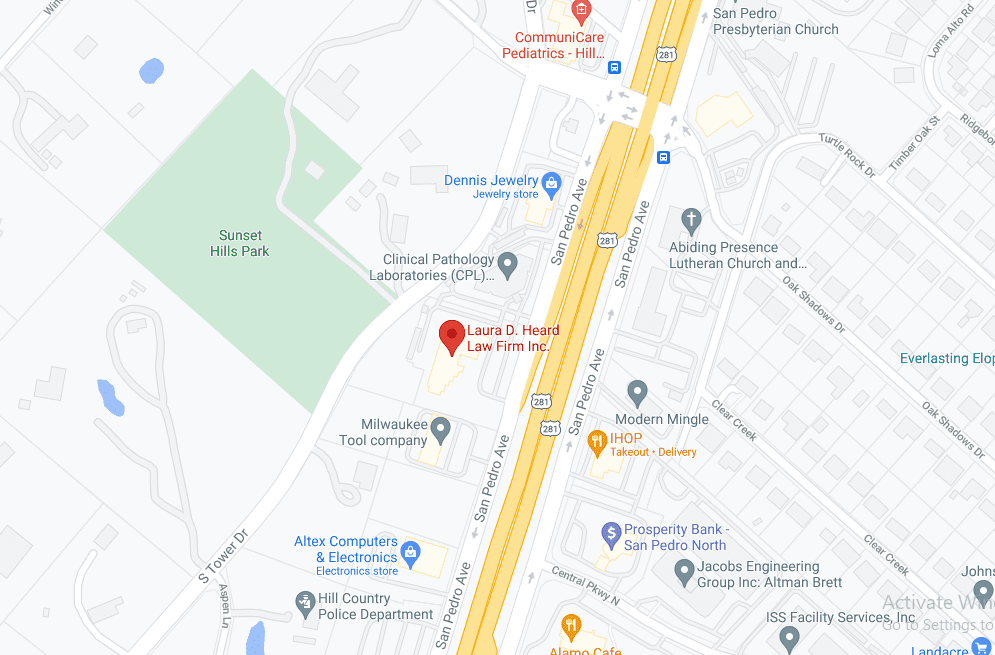

While the process can be lengthy and time-consuming, lawyers from a family law and estate planning firm in San Antonio can help you streamline it to navigate the challenges. With a proper outline of the tasks to carry out, probate can be less emotionally taxing and may take a shorter time. A probate attorney can help you stay out of trouble as you manage the property of the deceased person for the benefit of the heirs and beneficiaries. In many cases, the court will require that the executor be represented by an attorney since the executor has a duty to safeguard the property for other people.

Understanding Probate

If you understand probate, you will be in a better position to perform your role as an executor. Probate is a court-ordered legal process of managing a deceased person’s estate. The process may differ from case to case, and the specific steps may vary based on the type and size of estate to be administered.

Probate lawyers in San Antonio explain that an estate could be subject to one of the following types of probate:

- Probate of a Self-Proved Will with an Independent Executor

- Probate of a Will that is not Self-Proved or fails to name an Independent Executor

- Probate of a Will as a Muniment of Title

- An administration with Will annexed

- A Small Estate Affidavit where there is no Will, and

- An intestate Determination of Heirship and Dependent Administration, among other variations.

What Is the Role of an Executor in Probate?

As an executor in the probate process, your role is crucial, requiring you to ensure everything is handled correctly and assets safeguarded. San Antonio probate attorneys highlight the following critical responsibilities:

Determine if the Estate Must Undergo Probate

The decedent may have set up various estate planning tools to avoid probate. For example, if they set up a living trust and transferred their assets into it, you may be able to avoid probate. You can distribute the trust’s assets according to the terms of the trust agreement. However, you must go through probate if the trust holds no assets or if part of the estate is omitted from the trust.

Application for Administration or Probate of Will

Upon the demise of the estate owner, you should apply to the appropriate probate court for the administration of the estate, submitting the original Will and death certificate. The application lists basic information about the deceased, including the beneficiaries named in the Will and all heirs at law. The application must be filed within four years after the date of death. There is a short deadline once the application is filed in which to bring the original Will to the probate clerk for filing in the case. The death certificate may be submitted a little later but must be on file before the Executor or Administrator will be appointed. Keep in mind that until the Court appoints you, even though the Will has named you as executor, you have no authority. The Court must determine that the Will is valid and that there is no later Will revoking this Will.

Your attorney will prepare the Oath that you must sign, a Proof of Death affidavit, and a final Order for the Judge to sign. The court will schedule a hearing upon receiving the application to admit the Will, name you the executor, administer the Oath, and provide you with the fiduciary certificates as evidence of your authority to act on behalf of the estate. The fiduciary certificate you will receive is known as a Letter Testamentary or Letter of Administration. If no Will exists, the court will appoint an administrator, rather than an executor, but only after another attorney investigates to determine the identity of all the heirs.

If the Will is uncontested, the court can streamline the hearing process if the interested parties sign waivers. In Texas the process can be streamlined considerably if all the beneficiaries or heirs will agree to an Independent Administration, but without everyone’s agreement, unless there is a valid Will specifying an Independent Executor, then the default will be a dependent administration. This is one reason it is important to have your Will prepared by an attorney who is knowledgeable about Texas probate law and the Texas Estates Code, in order to have the Will drafted in such a way as to save time and money after you die by using the correct terminology for Texas law.

Locate the Will and Other Crucial Documents

It is your responsibility as an executor to locate other relevant documents associated with the estate and submit them for probate. Some of the crucial documents, in addition to the Will, are:

- Estate planning documents, such as trust documents

- Brokerage and advisory account statements

- Contact information of the decedent’s wealth manager

- Bank and retirement account information

- Social Security documents

- Credit cards and statements

- Deeds or certificates for land records

- Keys to any safe deposit boxes

Ensure you are thorough and meticulous to avoid overlooking any of the decedent’s assets. Sometimes, you might have to obtain professional appraisals to determine the accurate value of specific property. Working with experienced San Antonio probate lawyers can help you get the appraisals done more efficiently than you would have them done working alone.

Pay Expenses and Claims

The court will require you to publish a Notice to Creditors in a local newspaper, notifying them of the estate owner’s death so they can lay their claims against the estate. You must keep track of outstanding claims and debts to ensure you pay them off before distributing the estate to the beneficiaries. Examples of bills payable are:

- Funeral costs

- Ambulance bills

- Charges for nursing home services

- Expenses of last illness from doctors and hospitals

- Payable taxes

- Utility bills

- Mortgage and Insurance

- Costs of Administration, such as attorney fees

Distribute the Estate

Once you pay off the debts and settle taxes, it is time to distribute the remaining assets to the beneficiaries. Skilled estate planning lawyers in San Antonio can help you evaluate and thoroughly understand the wishes and instructions outlined in the Will to minimize mistakes.

If a property is not specifically assigned to a beneficiary in the Will or in a valid personal property designation form, you should sell it at a fair market value and distribute the proceeds to the beneficiaries.

During the distribution phase, it’s crucial to keep communication with the beneficiaries open and resolve any disputes from a legal perspective. Fairness and compliance are vital during this process to avoid trouble with the law. It would also be essential to encourage the beneficiaries to be patient and manage their expectations, given that probate can be sensitive.

A Skilled Estate Planning Lawyer Helping Executors Navigate Probate

Executors can find handling the complex probate process challenging, especially if they have no legal background in estate administration.

Working with experienced probate attorneys in San Antonio can help you understand and navigate this lengthy and sometimes complicated process. They can guide you accordingly to ensure you avoid costly mistakes that could result in a lawsuit.

South TX Family Law hosts knowledgeable probate and estate planning lawyers in San Antonio. We can provide legal guidance and help you streamline the probate process to save you time and money. Trust us to help with valuation, tax and debt management, and compliance with probate laws to protect you from liability. Call our law firm at 210-775-0353 to schedule a case assessment.