Are You Age 50 or Older?

If you’re approaching retirement, a divorce may be particularly difficult and complicated, and not just emotionally. If you’re older and you are divorcing in Texas, you need to be concerned about protecting your retirement savings. A San Antonio divorce lawyer can help.

The Pew Research Center tells us that the divorce rate for adults over age 50 has doubled in the last twenty-five years. The trend has even been given the name “gray divorce.” At any age, a divorce can be emotionally devastating, but after age 50, if you fail to protect your assets and resources, a divorce can also be financially devastating.

A San Antonio divorce attorney can ensure that any retirement funds that are rightfully yours and yours alone are protected throughout the divorce process. It is often helpful to consult with a tax expert as well when deciding which assets to claim because some assets may have more favorable tax consequences than others.

How Are Properties and Assets Divided in a Texas Divorce?

Texas courts presume that all of the property acquired during a marriage is community property. In many cases, an older couple’s most valuable assets are their retirement funds. After a lengthy marriage, how will a Texas divorce court divide and distribute a couple’s retirement funds?

If, during the marriage, either partner acquired property that should be designated as personal separate property, that partner must prove it with “clear and convincing evidence.” In Texas, all property is presumed to be community property unless the person claiming it as separate is able to prove that it is separate. The court divides community property in a “just and right manner” which generally means a 50-50 split, but not always. The court looks at the total picture of assets and debts and may trade off one asset for another, the marital home versus the retirement account for instance.

However, in some cases, unequal earning power or grounds for fault (such as adultery) may be considered in the division of assets and properties. The court will consider each couple’s unique financial details and circumstances when it divides the marital assets, properties, and debts.

Are Retirement Benefits Community Property?

Although retirement accounts may have only one designated account holder, any funds that are deposited to a 401K, a pension, or an IRA during the course of a marriage will be deemed community property by the court without regard to which partner actually earned the funds.

However, the full value of a pension or a retirement plan is not always community property – and, therefore, may not be subject to division. Only those retirement funds that were acquired during the marriage are considered community property.

How Are Pensions and 401Ks Divided in a Divorce?

The process of dividing pensions, IRAs, and 401Ks in a divorce – which involves determining which funds are separate property and which are community property in each account – is complicated by factors such as interest and the fluctuating value of the accounts, as well as any withdrawals or loans against the account.

In some cases, the divorcing spouses may agree not to divide retirement assets and may instead allocate the value of any retirement funds owed to either spouse into other, more easily divided assets. If retirement funds are divided, strict rules must be followed to avoid tax penalties. Often a separate retirement division order is required to avoid taxes and penalty for the split.

Plans provided by private employers, such as 401Ks and pensions, are subject to the federal Employee Retirement Income Savings Act (ERISA), which allows divorcing spouses to divide those retirement plans without incurring a tax penalty.

What is a QDRO?

Dividing a retirement plan that is subject to ERISA requires a Qualified Domestic Relations Order (QDRO). A QDRO is a court order that spells out how retirement assets must be distributed in a divorce. A QDRO:

- is issued separately from the divorce decree

- must comply with federal and state law and the requirements of the retirement plan

When a QDRO is issued, it is sent to the plan administrator for approval. If the QDRO is approved, the spouse who receives the assets may move them to an IRA without any tax penalty. However, if the spouse takes a distribution of the funds, that distribution is taxed as income unless the investment was already a ROTH IRA.

Similarly, military retirement, thrift savings plans, and pensions also require a separate retirement division order that must be sent to the proper administrator for approval, along with a certified copy of the divorce decree. These retirement division orders should be signed by the Judge at or near the same time that the divorce decree is signed.

How Are IRAs Divided?

IRAs – individual retirement accounts – aren’t subject to ERISA, so they are divided differently. IRA funds may be transferred to an ex-spouse without a tax penalty only if the transfer is specifically provided for in a settlement agreement at the time of divorce or in a divorce decree.

The decree or agreement must clearly set forth the amount to be transferred, and the spouse who receives the funds must establish a new IRA. If an IRA is divided in some other way, the spouse who is the designated account holder will face a tax penalty.

If your community property includes retirement benefits, it is vital to consult a San Antonio divorce lawyer – from the beginning of the divorce process – to ensure that any retirement funds are properly evaluated and distributed and that you are allowed to keep what is rightfully yours.

What Else Should You Know About Divorcing After Age 50?

Prior to a divorce proceeding in Texas, the divorcing spouses must complete a number of financial disclosure documents. Telling the truth about your finances is imperative in a divorce proceeding. Any exaggeration or misrepresentation will damage your credibility with the court.

At any age, knowing what to expect in a divorce eliminates confusion and allows you to focus on the issues. Be prepared. Ask questions. Read as much of the legal paperwork as you can. You’ll feel more confident, and you’ll be able to give your attorney more help as the case unfolds.

What will your divorce cost? Quite a lot if the divorcing spouses can’t agree about the division of assets and properties and other matters like alimony, child custody, and child support. Couples can save time and money and avoid aggravation if they can agree on some or all of these matters.

Who Should Handle Your Divorce in the San Antonio Area?

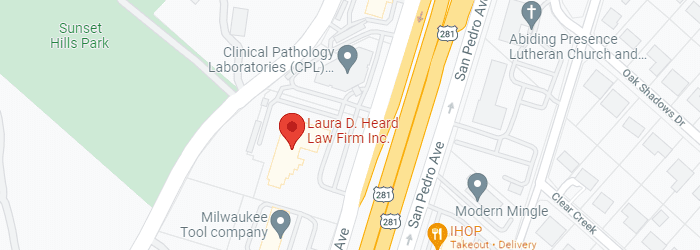

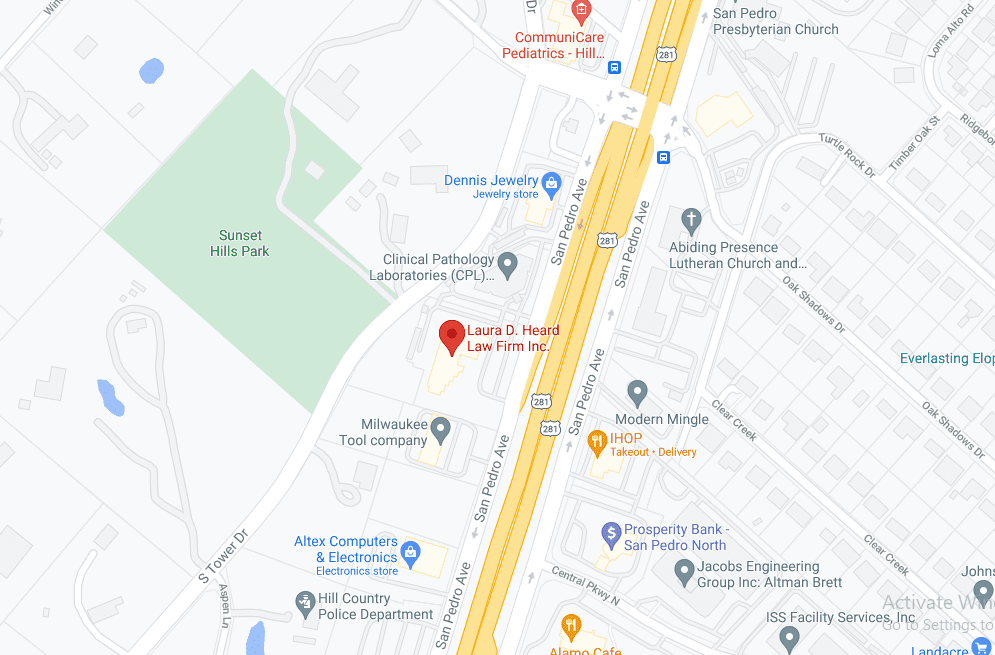

Family law and divorce are complicated in this state. If you are divorcing or considering divorce in the San Antonio area – or if a divorce emerges in your future – schedule a consultation immediately with the South TX Family Law Firm.

San Antonio divorce attorney South TX Family Law provides frank advice and ensures that her clients receive what is rightfully theirs at the end of the divorce process. From your first consultation until your divorce decree is issued, she will ensure that the court treats you fairly.

Attorney South TX Family Law will assess your legal needs and bring your divorce proceeding to its best possible conclusion. If you decide to divorce, or if your spouse has decided on divorce, call the South TX Family Law Firm at 210-775-0353, and let our legal team go to work for you.